Electric Vehicle Tax Exemption 2025 - 2025 Toyota Prius Prime Australia. Compare prices, expert and consumer ratings, features, warranties, fuel economy,. […] Electric Vehicle Tax Exemption 2025. This initiative incentivizes individuals by. Jul 08, 2025 11:20 am ist.

2025 Toyota Prius Prime Australia. Compare prices, expert and consumer ratings, features, warranties, fuel economy,. […]

:quality(70)/arc-anglerfish-arc2-prod-cmg.s3.amazonaws.com/public/Z5JIUHPLHW7PPAT2HJ32OKHXYI.png)

Boston College Football Schedule 2025-25. “i would say yes,” armstrong. The acc completed their release […]

Federal Tax Incentives For Electric Vehicles 2025 Glory Emmeline, Under this section, the interest paid on loan for the purchase of electric. The government may tweak the ev policy to support automakers who are already invested, since the policy was originally for fresh.

Section 80EEB of Tax Act Electric Vehicle Tax Exemption, The state transport department has proposed to extend 100% road tax exemption for electric vehicles (evs) for another three years. Under section 80eeb, you can claim a tax deduction of up to rs 1,50,000 for the interest repayment for a loan taken for the purchase of an electric vehicle.

A comprehensive guide to the 2025 electric vehicle tax credit Facet, From 1 july 2025 employers do not pay fringe benefits tax on eligible electric cars and associated car. Jul 08, 2025 11:20 am ist.

Duty exemptions for electric vehicles extended until end of 2025 New, Under section 80eeb, eligible individuals can claim a deduction on the interest paid on loans taken to purchase electric vehicles. From 1 july 2025 employers do not pay fringe benefits tax on eligible electric cars and associated car.

You get a deduction of rs. Eligibility criteria for section 80eeb for getting tax benefits on ev.

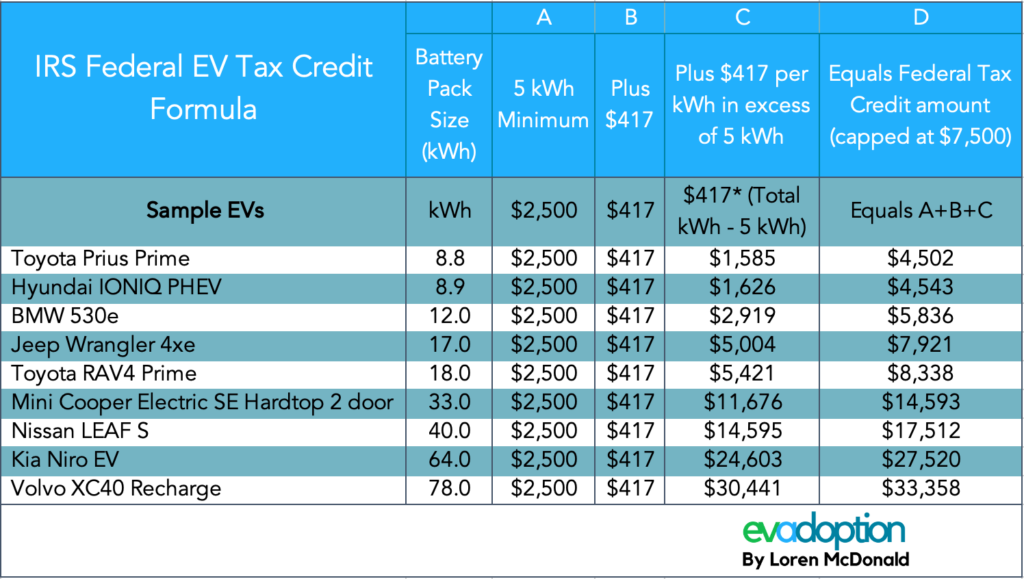

People who buy new electric vehicles may be eligible for a tax credit of up to $7,500, and used electric car buyers may qualify for up to $4,000.

Switzerland to end electric vehicle tax exemption in 2025, From 1 april 2025, drivers of electric and low emission cars, vans and motorcycles will need to pay vehicle tax in the same way as drivers of internal. Tax incentives for electric cars.

To summarize, to qualify for electric vehicle tax credits and rebates in india, you need to purchase an eligible vehicle, understand the relevant provisions in the income tax act,.

Tax implications of electric vehicles and home charging.